For 2022, I decided to blog about things that interest me. Oh no, not another blog, you say. Did you know that are about 31.7 million bloggers in the US, roughly 10% of the country’s population? So, do we need another blog? Probably not! Then why blog? That is a blog in itself. However, the long and short of it is that I view blogging as an exercise to distill my thoughts on issues that are of interest to me.

So here goes! I am going to kick off the blog with a mishmash of trends/issues I will track in retail for 2022

IS THIS THE YEAR FOR RETAIL AUTOMATION?

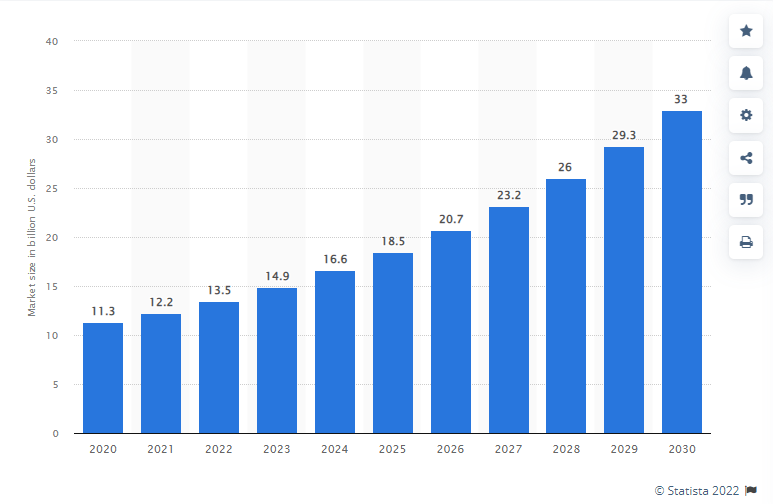

Global Retail Automation Market, Source: Statista 2022

2021 saw an increasing number of retailers experimenting with automation, from autonomous delivery robots to autonomous stores, from shelf-scanning robots to warehouse automation robots. In addition, customer acceptance of such innovations dramatically increased. While the trend towards automation predates the pandemic, growing evidence of return on investment and operational efficiency of robots (listen to the Center’s panel on this issue) combined with real wage inflation ($18 an hour for distribution center (DC) employees) and labor shortages will see 2022, be the year of automation. Supporting this thesis, a 2021 study conducted by RetailWire and Brain Corp, found that 73% of large retailers say that the importance of using robotics in warehouses or DC has increased due to factors that emerged during the pandemic. My own perspective is that as an increasing number of companies experiment with automation, there will be more evidence that automation has the power to transform retail business models (e.g., PizzaHut’s fully robotic restaurant), enable personalization and convenience to a level not experienced thus far, empower workforce to engage in high-value and meaningful activities, and increase firm agility in responding to changing customer demands. This will drive exponentially increase in adoption of automation in retail. But let it be clear, my belief is that automation will not replace human workforce, it will eliminate drudgery from current jobs and make retail a more exciting sector to work in. That said, automation is going to cause worker displacement. WEF Future of Jobs 2020 reports highlights that by 2025, 85 million global jobs will disappear as a consequence of automation. As responsible businesses and retailers, let’s not shy away from the tough conversations on how to upskill and reskill the workforce, how to manage the transition, and how to strike a balance between automation and human workforce.

DOES THE GREAT RETAIL EXPERIMENTATION FALTER?

Retailers across the board have seen the pandemic as a license to experiment with the past two years seeing an explosion in retailers experimenting with various technologies and business models to improve operational inefficiencies and/or customer experience. The widespread adoption of BOPIS is perhaps the most reflective statistic of this statement. I see this trend accelerating in 2022, particularly the first half. I believe that what has historically been a laggard industry when it comes to innovation, will wake up to the power of innovation primarily due to increased market expectations (more on this in a later blog). It will be interesting to see what the next wave of experimentation brings – from technology-enabled innovations such as automation, NFT, and metaverse plays, to more unique and unusual partnerships and customer engagement efforts. Importantly, will this level of experimentation persist moving forward? We are heading into some headwinds with consumer confidence slipping, inflation rising, and supply chain woes continuing. Will retailers continue to remain agile and bold when the going gets tough? Or will they revert to older days of cost savings and incremental innovations? As companies grapple with ways to incorporate emerging technologies into their business models, failure is bound to occur. While most executives and academics realize that failure is lifeblood of innovation (according to Christensen 95% of innovations fail), dealing with failure is hard and oftentimes scars companies and individuals making them hesitant to engage in innovation, especially the radical, new-to-the-world type of innovation. How are organizations going to react to failure? Time will tell.

Retailers across the board have seen the pandemic as a license to experiment with the past two years seeing an explosion in retailers experimenting with various technologies and business models to improve operational inefficiencies and/or customer experience. The widespread adoption of BOPIS is perhaps the most reflective statistic of this statement. I see this trend accelerating in 2022, particularly the first half. I believe that what has historically been a laggard industry when it comes to innovation, will wake up to the power of innovation primarily due to increased market expectations (more on this in a later blog). It will be interesting to see what the next wave of experimentation brings – from technology-enabled innovations such as automation, NFT, and metaverse plays, to more unique and unusual partnerships and customer engagement efforts. Importantly, will this level of experimentation persist moving forward? We are heading into some headwinds with consumer confidence slipping, inflation rising, and supply chain woes continuing. Will retailers continue to remain agile and bold when the going gets tough? Or will they revert to older days of cost savings and incremental innovations? As companies grapple with ways to incorporate emerging technologies into their business models, failure is bound to occur. While most executives and academics realize that failure is lifeblood of innovation (according to Christensen 95% of innovations fail), dealing with failure is hard and oftentimes scars companies and individuals making them hesitant to engage in innovation, especially the radical, new-to-the-world type of innovation. How are organizations going to react to failure? Time will tell.

DOES THE FIRM’S SUSTAINABILITY IMPERATIVE MEET THE TRANSPARENCY IMPERATIVE?

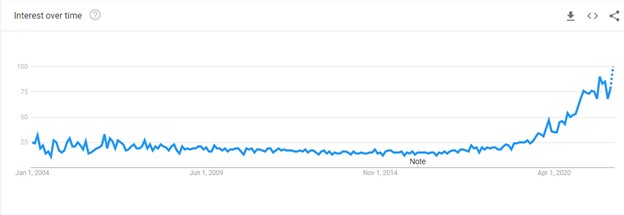

I am a sustain ability researcher and I believe this is a greenfield for retailers. Therefore, the third trend I will be tracking closely is the sector’s sustainability efforts. I will look at it from two fronts. First, what are a company’s ESG efforts? Specifically, what is the relative emphasis on environmental versus social aspects? And how do companies use the ESG efforts to connect with customers and create value for customers? The second factor I will track is a discrepancy between a company’s sustainability claims and its actual performance. Called greenwashing, when this discrepancy is with regards to a firm’s green claims, a recent study by International Consumer Protection Enforcement Network found that 40% of firms’ green claims to be misleading. In my opinion, much of this is because we don’t have a common agreement on what “sustainability” entails (we need to better define the sandbox boundaries by industry) and there is confusion and misinformation on sustainability. Every organization seems to be throwing around the word ESG these days. Google search trends on ESG supports my claims that all of a sudden, ESG is on everyone’s lips. Good thing is that there is increased scrutiny of these claims and efforts to hold companies accountable. I personally think that the wild wild west days of sustainability efforts are numbered (let it be clear they are many companies who are authentically engaging in ESG efforts). For example, Morningstar stripped 1200 funds of the ESG tag after a forensic analysis. I actually seem this increasing in the futures and companies are going to held accountable for their claims. I also see increased regulations in this space. Thus, the second aspect that I will be closely tracking is the scrutiny on a firm’s sustainability efforts (i.e., its transparency) and the backlash that firms receive if these efforts are identified as inauthentic.

ability researcher and I believe this is a greenfield for retailers. Therefore, the third trend I will be tracking closely is the sector’s sustainability efforts. I will look at it from two fronts. First, what are a company’s ESG efforts? Specifically, what is the relative emphasis on environmental versus social aspects? And how do companies use the ESG efforts to connect with customers and create value for customers? The second factor I will track is a discrepancy between a company’s sustainability claims and its actual performance. Called greenwashing, when this discrepancy is with regards to a firm’s green claims, a recent study by International Consumer Protection Enforcement Network found that 40% of firms’ green claims to be misleading. In my opinion, much of this is because we don’t have a common agreement on what “sustainability” entails (we need to better define the sandbox boundaries by industry) and there is confusion and misinformation on sustainability. Every organization seems to be throwing around the word ESG these days. Google search trends on ESG supports my claims that all of a sudden, ESG is on everyone’s lips. Good thing is that there is increased scrutiny of these claims and efforts to hold companies accountable. I personally think that the wild wild west days of sustainability efforts are numbered (let it be clear they are many companies who are authentically engaging in ESG efforts). For example, Morningstar stripped 1200 funds of the ESG tag after a forensic analysis. I actually seem this increasing in the futures and companies are going to held accountable for their claims. I also see increased regulations in this space. Thus, the second aspect that I will be closely tracking is the scrutiny on a firm’s sustainability efforts (i.e., its transparency) and the backlash that firms receive if these efforts are identified as inauthentic.

DOES THE STARTUP MARKET CONTINUE TO SIZZLE?

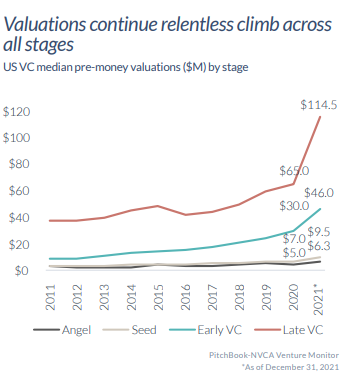

2021 was a banner year for venture capital investment with a record $671 billion invested in 38,644 deals, according to “Venture Pulse”, a report by KPMG Private Enterprise. Pitchbook -NVCA report noted that angel, early, and late-stage venture investments have doubled. Importantly, as the Pitchbook-NVCA visual shows, valuations continue to skyrocket irrespective of the stage of the venture. According to CB Insights, retail technology investments followed the larger trends with a recording setting 109 billion dollars (up a 132% from last year) flowing into retail technology startups, an average annual deal size equating to 36M (which was 71% more than 2020), and historic high number of unicorns in retail technology (97). But can these trends keep up? We are seeing a structural shift toward greater investments in technology, but some experts are raising some concerns. With technology stocks getting routed at the start of 2022, is it possible that private markets follow suit? How are the macroeconomic headwinds going to factor in? What will happen to the companies who have raised large amounts of capital despite business models that might not be sustainable? How many women and minority startups are funded? The questions abound.

2021 was a banner year for venture capital investment with a record $671 billion invested in 38,644 deals, according to “Venture Pulse”, a report by KPMG Private Enterprise. Pitchbook -NVCA report noted that angel, early, and late-stage venture investments have doubled. Importantly, as the Pitchbook-NVCA visual shows, valuations continue to skyrocket irrespective of the stage of the venture. According to CB Insights, retail technology investments followed the larger trends with a recording setting 109 billion dollars (up a 132% from last year) flowing into retail technology startups, an average annual deal size equating to 36M (which was 71% more than 2020), and historic high number of unicorns in retail technology (97). But can these trends keep up? We are seeing a structural shift toward greater investments in technology, but some experts are raising some concerns. With technology stocks getting routed at the start of 2022, is it possible that private markets follow suit? How are the macroeconomic headwinds going to factor in? What will happen to the companies who have raised large amounts of capital despite business models that might not be sustainable? How many women and minority startups are funded? The questions abound.

DOES DTC GO HYBRID?

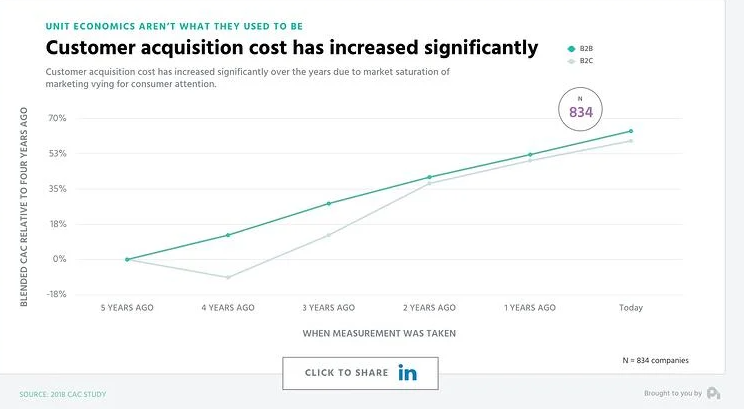

2021 saw several DTC brands open stores. Conceivably, there are numerous reasons for this from rising customer acquisition cost, to supply chain woes making it difficult to deliver products promptly, from opportunities to gather real-estate at “deals” to a realization that stores can expand brand awareness and provide customers with experiential aspects that might not be possible in a DTC environment. I believe that due to the strength of these factors, we will see more DTC brands experimenting with opening stores and experimenting with different interpretations of what a store means to the consumer. Relatedly, as product proliferation continues (did you know that on average, just the CPG space 30,000 new products are launched each year), as the number of “channels” for communication with customers increase as experts talk about metaverse and livestreaming and influencer marketing gets a redo, I believe that customer acquisition costs are going to increase dramatically. How does this impact DTC brands? How does this alter the retail landscape? To me these developments favor the larger, incumbent firms, but they also provide opportunities for the creative and agile SMB retailer to attract new customers and build customer loyalty.

2021 saw several DTC brands open stores. Conceivably, there are numerous reasons for this from rising customer acquisition cost, to supply chain woes making it difficult to deliver products promptly, from opportunities to gather real-estate at “deals” to a realization that stores can expand brand awareness and provide customers with experiential aspects that might not be possible in a DTC environment. I believe that due to the strength of these factors, we will see more DTC brands experimenting with opening stores and experimenting with different interpretations of what a store means to the consumer. Relatedly, as product proliferation continues (did you know that on average, just the CPG space 30,000 new products are launched each year), as the number of “channels” for communication with customers increase as experts talk about metaverse and livestreaming and influencer marketing gets a redo, I believe that customer acquisition costs are going to increase dramatically. How does this impact DTC brands? How does this alter the retail landscape? To me these developments favor the larger, incumbent firms, but they also provide opportunities for the creative and agile SMB retailer to attract new customers and build customer loyalty.

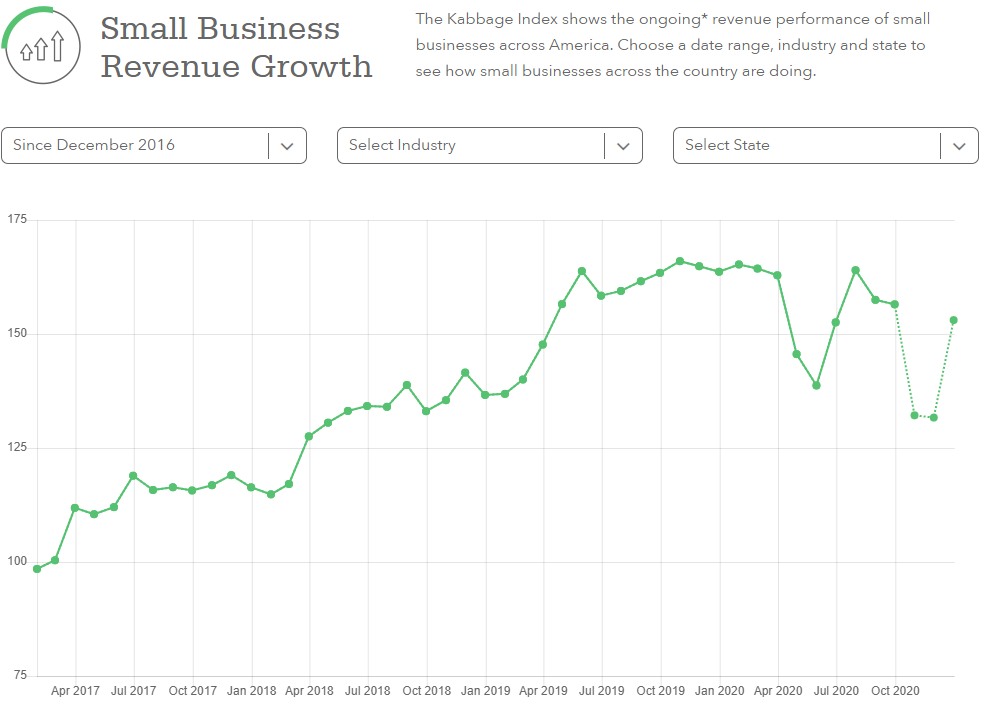

IS THERE A SMALL RETAIL RESURGENCE?

According to NRF, 98% of all retail is SMB retail. There is no doubt that the pandemic had wreaked havoc on SMB retail. Forced to shut down and with many retailers not having a digital presence, revenues faltered dramatically as the high streets emptied. Temporary closures turned into full-time closures. But this period also showed the creativity and resilience of SMB to react to adverse circumstances as the community rallied around the small retailers. Indeed, a study conducted by Union Bank in 2020 showed that respondents felt a responsibility to support small businesses and they were also willing to pay more to shop at a small retailer. While SMB retail has shown remarkable fortitude to navigate 2020 and 2021, 2022 brings new challenges in the form of supply chain woes, labor shortages, continued work from home environment, and inflation. Can SMB retail continue to show creativity in responding to highly challenging market conditions? Can they find ways to continue to stay connected with customers? Stock their shelves (physical or digital) as supply chains remain stressed? Will they continue to increase to accelerate technology adoption? Will consumers continue to patronize SMB retail as COVID is in our rear-view mirror? The questions abound, the answers unknown. If I were a betting person, I would bet that 2022 is the year of the small retailer as they leverage technology and superior customer connectivity to make further strides.

According to NRF, 98% of all retail is SMB retail. There is no doubt that the pandemic had wreaked havoc on SMB retail. Forced to shut down and with many retailers not having a digital presence, revenues faltered dramatically as the high streets emptied. Temporary closures turned into full-time closures. But this period also showed the creativity and resilience of SMB to react to adverse circumstances as the community rallied around the small retailers. Indeed, a study conducted by Union Bank in 2020 showed that respondents felt a responsibility to support small businesses and they were also willing to pay more to shop at a small retailer. While SMB retail has shown remarkable fortitude to navigate 2020 and 2021, 2022 brings new challenges in the form of supply chain woes, labor shortages, continued work from home environment, and inflation. Can SMB retail continue to show creativity in responding to highly challenging market conditions? Can they find ways to continue to stay connected with customers? Stock their shelves (physical or digital) as supply chains remain stressed? Will they continue to increase to accelerate technology adoption? Will consumers continue to patronize SMB retail as COVID is in our rear-view mirror? The questions abound, the answers unknown. If I were a betting person, I would bet that 2022 is the year of the small retailer as they leverage technology and superior customer connectivity to make further strides.

So that is it. Those are the issues in retail that I am going to track closely. What do you think?

Thank you for the post on your blog. Do you provide an RSS feed?

Thanks for your blog, nice to read. Do not stop.

Great article.